Digital Products Aren’t Bridges

Why Funding Digital/AI Products as Projects leads to stagnation

Many companies have embarked on digital transformation, and AI adoption, yet the majority struggle to achieve their goals.

Research confirms that a staggering 70% of large-scale transformations fail. This sobering statistic stems from three foundational challenges, one of which is the necessity of being outcome-focused. Becoming outcome-focused starts with how investments are funded.

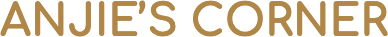

This is a costly error. The traditional, annualized, project-based funding process works well for finite projects where success is measured by completion and designed for fixed lasting value (e.g. a bridge). This approach is not a good match for building successful digital products (e.g., Google Maps), where value compounds over time, with continuous feature releases, and new integrations.

I have seen this failure firsthand at Fortune 500 companies and others. The legacy funding model creates a vicious cycle where up to 80% of technology spend is dedicated to “keeping the lights on” (maintenance activities), structurally starving high growth product teams of innovation capital. This results in missed critical opportunities to improve adoption and increase revenue.

To retain their competitive advantage, companies must shift away from legacy project-based funding models and operationalize a Product Investment Model.

The Problem in a Picture: A Bridge versus Google Maps

The core of this distinction, and its financial consequence is perhaps best illustrated by a simple contrast:

The Project Funding Trap

The rigid, transactional model of project-based funding (fixed investment focused on completing a deliverable), is fundamentally unsuitable for digital/AI products. Here are the four critical strategic risks:

Stagnation: Project model assumes success is achieved at launch, eliminating the sustained capital required for continuous value creation. This results in the product’s descent into irrelevance while competitors evolve.

Misalignment of Metrics: Success is incorrectly measured by budget compliance (“On time, on budget”) rather than business outcomes (e.g. revenue, conversion, retention). This incentivizes teams to deliver code rather than commercial value.

Compounding Debt (Reduced Product Velocity): Fixed deadlines pressure teams to forgo sound architecture or quality. This creates technical debt, trapping the enterprise in expensive maintenance cycles.

Erosion of Institutional Knowledge: Project teams are temporary and often disbanded upon completion resulting in the loss of deep customer understanding and domain expertise critical for maintaining product velocity and compounding growth.

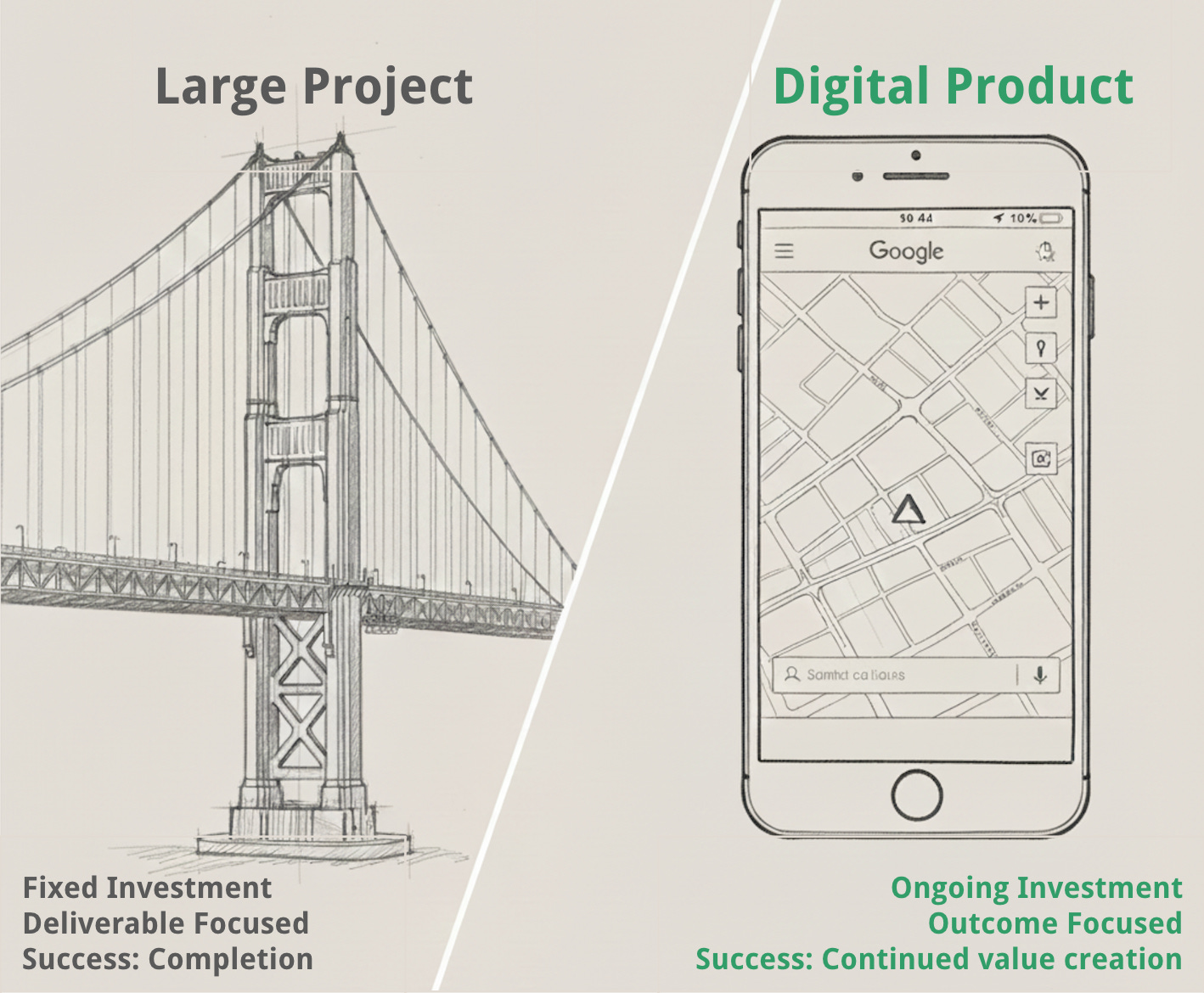

Product Investment Model: A Playbook for Operationalizing Product Funding

We need to shift our mindset to treat digital products as “venture capital portfolios” where investment is continuous and conditional upon demonstrated results and growth. My work with established enterprises has confirmed this model works, and I want to share my playbook.

Fund the Team, Not the Deliverable: Establish durable, persistent cross functional Product Teams (not temporary project crews). Allocate continuous funding to the team itself, viewing it as a growth engine fueled by operational capital. The focus shifts entirely to outcomes, not just output.

Align Authority with Accountability: Give investment authority directly to the functions accountable for commercial outcomes (e.g. CPO, CRO, CEO). The individuals signing the checks must be the P&L owners.

Implement a Product Portfolio Review: Replace rigid annual budgeting with a quarterly product review. All product teams must defend their budget based on demonstrated value (conversion, retention, revenue). This enforces continuous accountability and allows you to strategically divest from low-growth products.

The Mandate for Product Investment Model

Digital products are not projects with a finish line; they are a living, compounding growth engine. To compete and lead in digital, we must fundamentally shift the mindset away from the “one-and-done” model.

Digital product is a living, compounding growth engine

My playbook is more than just theory. It is informed by my time leading products at world-class digital native companies, and uniquely validated by my experience successfully implementing these transformations within established enterprises. This approach ensures rapid, real-world results.

Companies have the talent and the resources. They also need an operating model that effectively directs capital to enable teams to drive value.

The Product Investment Model restructures capital allocation to accelerate growth, mitigate the risk of obsolescence, and strengthen a company’s enduring competitive position. It is the critical pillar for any successful digital transformation.

👇I welcome your insights, organizational challenges or observed successes. Contact me directly to discuss and delve deeper into digital transformation.